678-404-2394

Unlock Your Policy's Potential with Expert Life Settlements

At Affordable Life Benefits, we help seniors explore the hidden value of their unwanted or unaffordable life insurance policies. We’re here to guide you with compassion and clarity, offering non-binding complimentary policy appraisals to help you understand the full value of your assets, and help you make the best decision for yourself, your loved ones and your legacy.

Unlock Your Policy's Potential with Expert Life Settlements

At Affordable Life Benefits, we help seniors explore the hidden value of their unwanted or unaffordable life insurance policies. We’re here to guide you with compassion and clarity, offering non-binding complimentary policy appraisals to help you understand the full value of your assets, and help you make the best decision for yourself, your loved ones and your legacy.

Click Play to Learn More About Life Settlements:

Click Play to Learn More:

Explore Life Settlement Solutions

Maximize your financial freedom today

Comprehensive Life Settlement Evaluations

Life Settlement Evaluations: We offer comprehensive policy assessments to ensure maximum value from potential life settlements for existing life insurance policies. Start your free appraisal today and find out how much you may qualify for. There's no obligation to continue, just valuable information about your assets to help you make an educated decision about your future.

Expert Brokerage Services

At Affordable Life Benefits, we specialize in securing the highest possible life settlement offers by connecting policyholders with our expansive network of competitive institutional investors. Our experienced team manages the entire process, from policy evaluation to final sale, acting as trusted mediators to ensure transparency, professionalism, and maximum value. Because we create a bidding environment among multiple buyers, our clients consistently receive higher settlement payouts compared to traditional brokers. Whether you're looking to eliminate costly premiums, access cash for retirement, or simply no longer need your policy, we’re here to help you unlock its full financial potential.

Comprehensive Life Settlement Evaluations

Our life settlement evaluation process is designed to give you a clear, honest picture of your policy’s true market value. We conduct a thorough assessment of your life insurance coverage—considering factors such as age, health, policy type, and premium cost—to determine if a life settlement is the right financial move for you. With access to a large network of competing investors, we create a bidding environment that helps maximize your potential payout. Again, there’s no cost or obligation for the evaluation—just a transparent way to explore whether your policy can be transformed into a valuable cash asset.

Continued Financial Planning Support

Financial Guidance Post-Settlement: After helping you unlock the value of your existing life insurance policy, our support doesn’t stop there. Many of our clients choose to use a portion of their settlement to fund a more affordable final expense policy, ensuring their loved ones are protected without the burden of high premiums. Our goal is to help you turn a costly obligation into a strategic financial asset that fits your current needs and future goals.

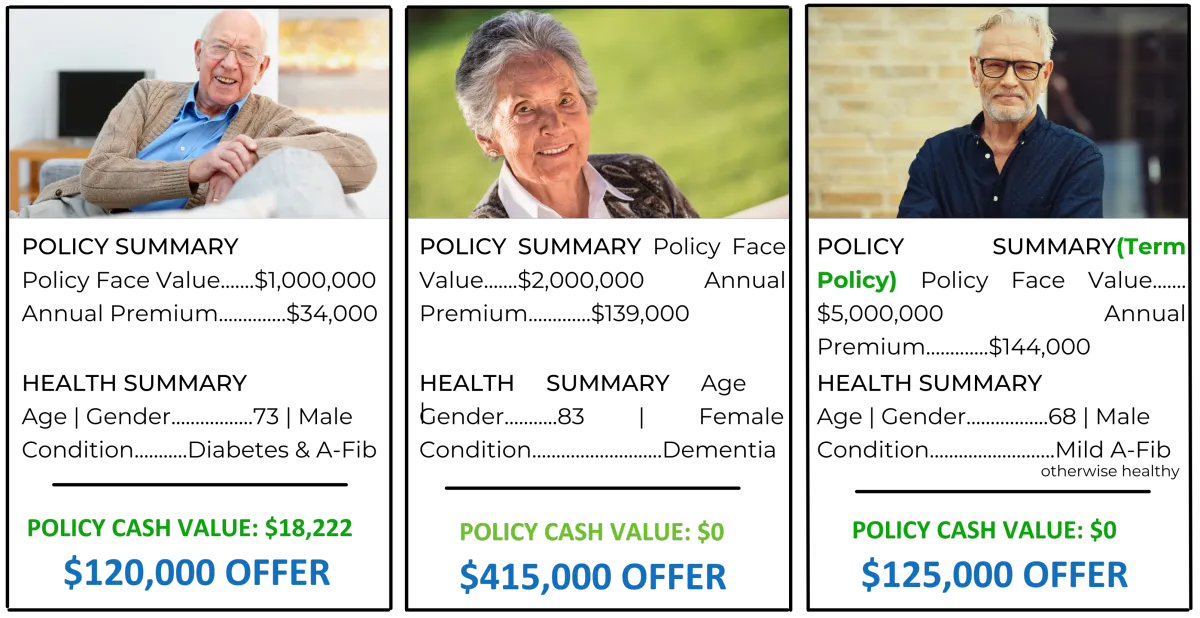

Real Settlements Provided By Our Company

FAQs

Your Questions Answered: Understanding Life Settlements

What is a life settlement?

A life settlement involves selling your life insurance policy to a third party for a value greater than its cash surrender value but less than its net death benefit.

How do I know if my policy qualifies for a life settlement?

Policies usually qualify if they are longstanding and the insured is 65 or older. We provide complementary appraisals at no cost or obligation.

Is selling my policy the only option?

No, you always have a choice! You can continue with your policy as is, convert it if that option is affordable for you, or choose a Life Settlement to receive cash from your unwanted or unaffordable policy now.

How long does the life settlement process take

The process typically takes 4-9 weeks from start to finish, where you'll receive the funds via check or wire directly into your bank account.

Are there any risks involved in life settlements?

While a life settlement can offer immediate financial benefits, there are considerations such as losing the death benefit and potential tax implications. We discuss these thoroughly to help you make an informed decision.

How is the value of my policy determined?

The value is influenced by factors like policy size, health, premium costs, and life expectancy.